Shuchita Solved Scanner Combo CMA Inter Group 1 (Financial Accounting + Financial Accounting + Direct and Indirect Taxation + Cost Accounting) New Syllabus Applicable for 2025 Exam

₹1,400.00

(Shuchita Solved CMA Scanner) CMA Inter Group 1 New Syllabus Applicable for 2025 Exam:

-

Business Laws and Ethics

-

Financial Accounting

-

Direct and Indirect Taxation

-

Cost Accounting

Out of stock

SKU: ShuCMAintScG1

Categories: CMA, CMA Intermediate

(Shuchita Solved CMA Scanner) CMA Inter Group 1 (Business Laws and Ethics + Financial Accounting+ Direct and Indirect Taxation + Cost Accounting) New Syllabus Applicable for 2025 Exam

(Shuchita Solved CMA Scanner) CMA Inter Group 1 (Business Laws and Ethics+ Financial Accounting + Direct and Indirect Taxation + Cost Accounting) New Syllabus 2025 Exam

Follow Us On Facebook

| Weight | 1.5 kg |

|---|---|

| Dimensions | 24 × 16 × 3 cm |

Only logged in customers who have purchased this product may leave a review.

Related products

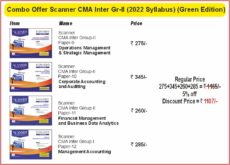

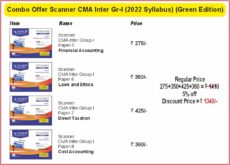

-5%

-5%

-16%

-18%

-11%

Reviews

There are no reviews yet.